Value Added Tax (VAT) is invoice based and is accounted for on invoices generated on both cash and credit sales. The VAT payable is the difference between output tax and input tax. Output tax is the tax charged on supplies made while input tax is the tax incurred by the registered operator on the supply of taxable goods and services. For one to claim input tax, he or she must be in possession of a valid tax invoice. It is important to note that input tax can only claimed on goods or services used to make taxable supplies. Operators should not include invoices on the input tax schedule that were not used to make taxable supplies even though tax was charged.

In some cases VAT registered operators encounter difficulties in identifying correct tax invoices for use in claiming input tax. In most cases operators claim input tax using any document that they would have received from their suppliers. This results in Zimra disallowing them and this results in unnecessary delays in claiming refunds. It is therefore vital that an operator have a clear understanding of the salient features to be contained on a VAT invoice and demand that this information be included at the same time a purchase of goods or service is made.

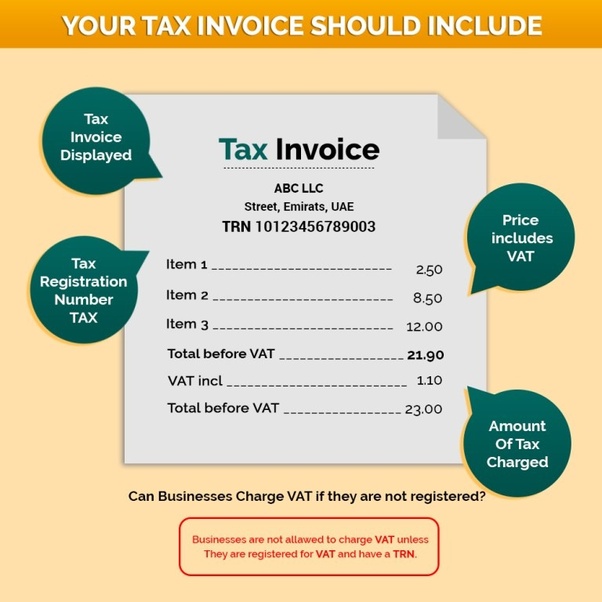

Salient Features to be included on a VAT Invoice

A valid tax invoice should have the following mandatory features:

v The words “tax invoice” should be in a prominent place;

v the name, address and VAT registration number of the supplier;

v the name and address of the recipient and if recipient is a registered operator, the VAT registration number of the recipient;

v an individual serialized number and the date upon which the tax invoice is issued;

v a description of the goods or services supplied;

v the quantity or volume of the goods or services supplied;

v Price and VAT charged

In some cases operators accept invoices without supplier’s VAT registration number, the recipient’s address or VAT number and used to claim input tax. It should be emphasized that only invoices bearing all the above stated salient features are accepted by ZIMRA for use in claiming input tax. It should also be noted that input tax is only claimable on tax invoices issued by a supplier who is registered for VAT.

In the event of any attempts being made to claim input tax using an invalid tax invoice, this results in the amount incorrectly claimed being disallowed and a penalty of 100% is levied in accordance with Section 66 of the VAT Act. Where a client suspects that he/she is dealing with a suspicious supplier, he or she is free to contact the nearest ZIMRA office for confirmation as to whether the supplier is registered for VAT or not.

To facilitate speedy processing of vat refunds it is important that operators adhere to the requirements of a valid tax invoice so that they can successfully claim input tax and avoid unnecessary delays in claiming the refunds.

Provisions covering the treatment of supplies for VAT purposes are specifically covered in the VAT Act and the VAT Regulations and registered operators are encouraged to familiarize with both pieces of legislation. In cases where the operator does not understand the VAT Act and the VAT Regulations it is important that they seek the services of a qualified tax consultant.

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Contact Number’ type=’text’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form]