by Innocent Machabe | Jul 20, 2018 | Taxation

What is Capital Gains Tax? Capital Gains Tax (CGT) is a tax levied on the capital gain arising from the disposal of a specified asset. Specified asset means immovable property (e.g. land and buildings) and any marketable security (e.g. debentures, shares, unit trusts,...

by Innocent Machabe | Jun 6, 2018 | Taxation

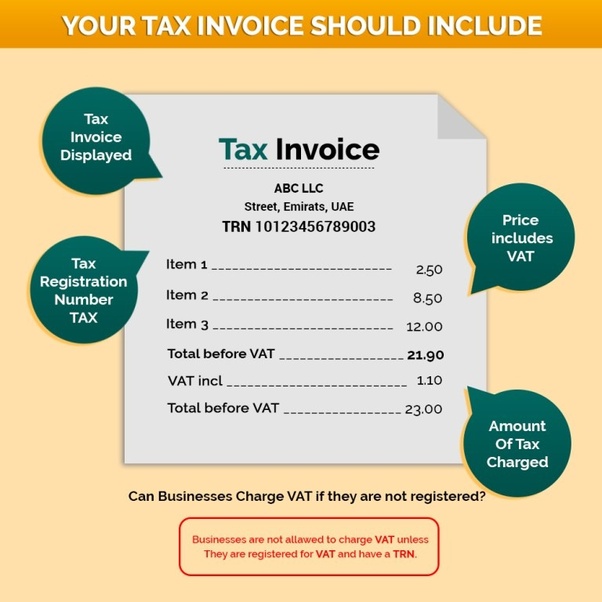

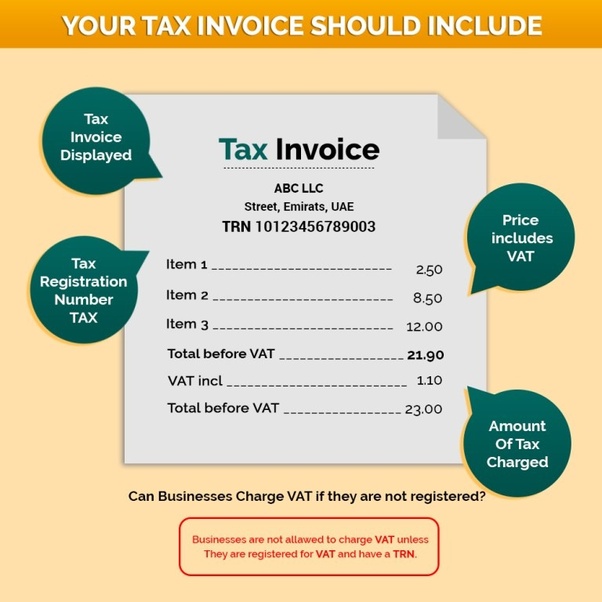

Value Added Tax (VAT) is invoice based and is accounted for on invoices generated on both cash and credit sales. The VAT payable is the difference between output tax and input tax. Output tax is the tax charged on supplies made while input tax is the tax...

by Innocent Machabe | May 23, 2018 | Taxation

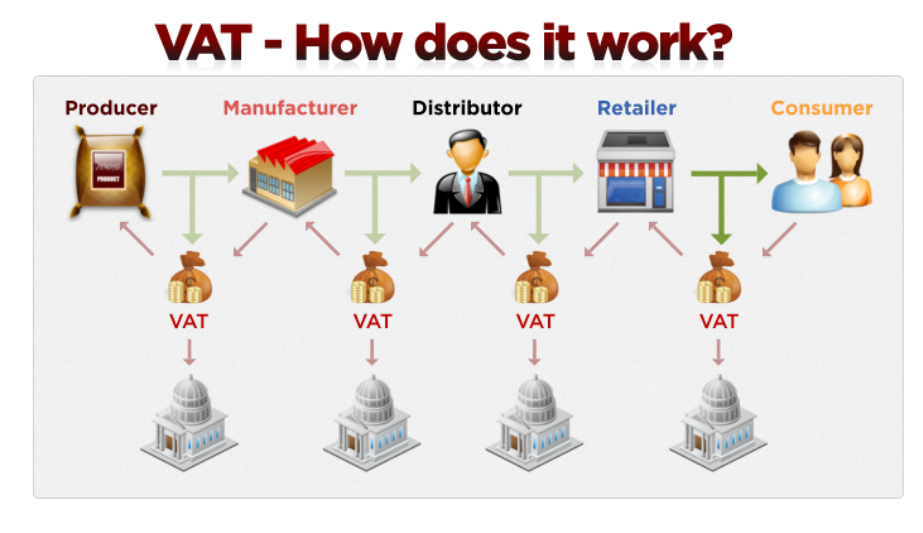

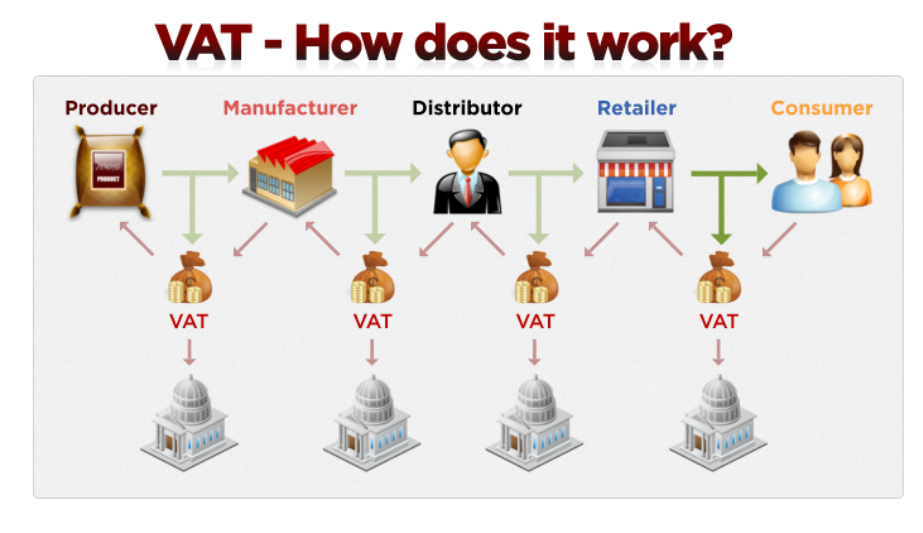

1. What is VAT? Value Added Tax (VAT) is an indirect tax on consumption, charged on the supply of taxable goods and services. It is levied on transactions rather than directly on income or profit, and is also levied on the importation of goods and services....

by Innocent Machabe | Apr 27, 2018 | Taxation

Bad debts arise when customers who buy on credit fail to pay the debt and this triggers the trader to claim a deduction against their income for Income Tax purposes. The debt that is allowable as a deduction is that debt which the trader proves to be irrecoverable....