by Innocent Machabe | Jun 6, 2018 | Taxation

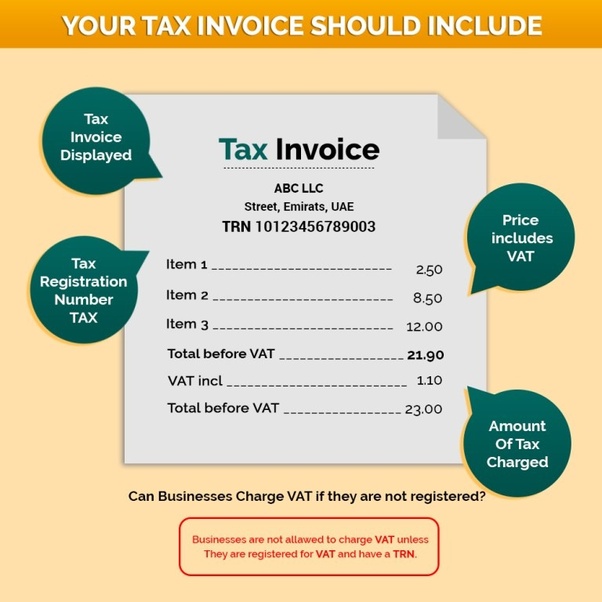

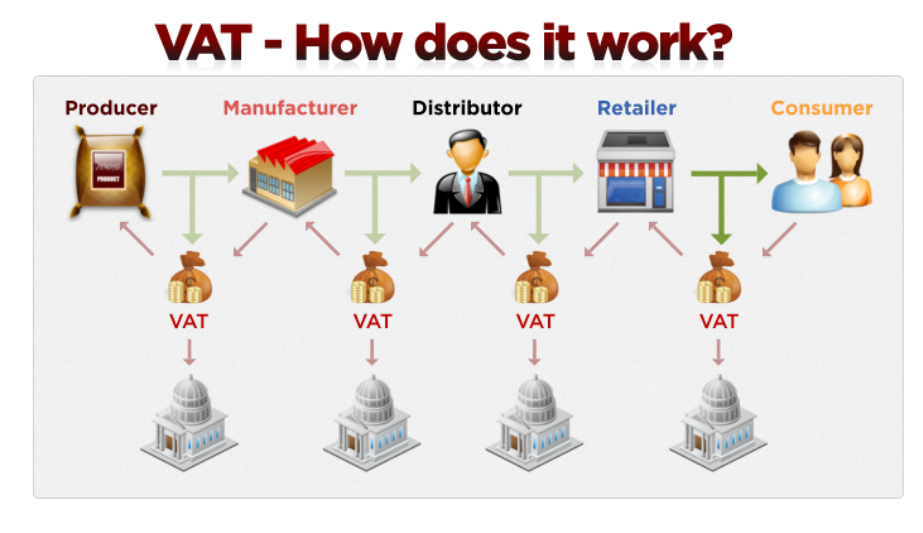

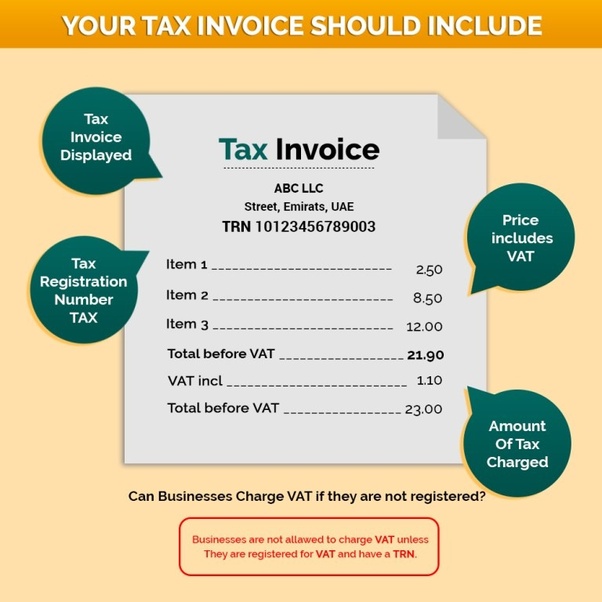

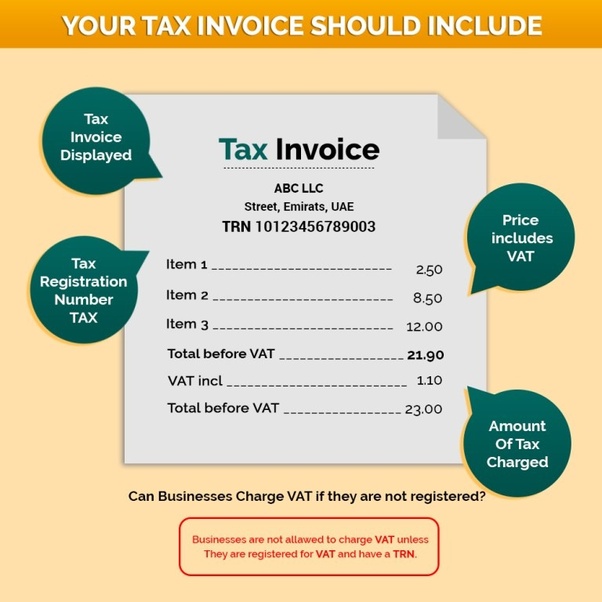

Value Added Tax (VAT) is invoice based and is accounted for on invoices generated on both cash and credit sales. The VAT payable is the difference between output tax and input tax. Output tax is the tax charged on supplies made while input tax is the tax...

by Innocent Machabe | May 23, 2018 | Taxation

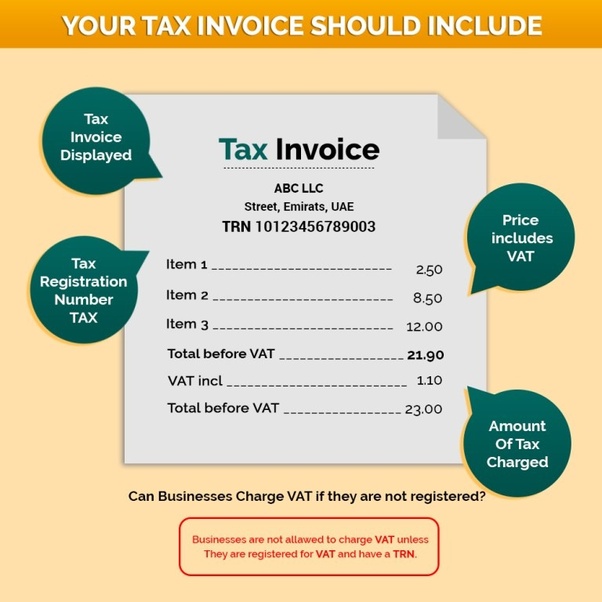

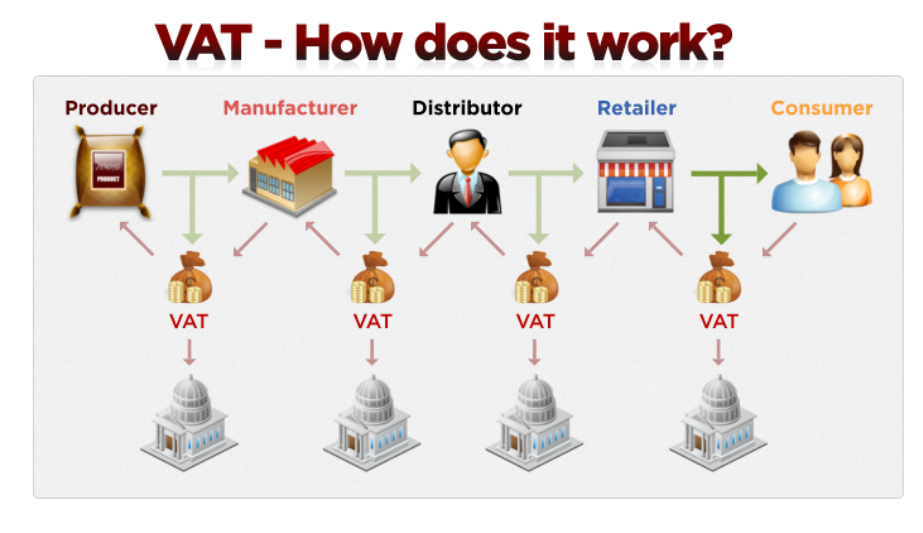

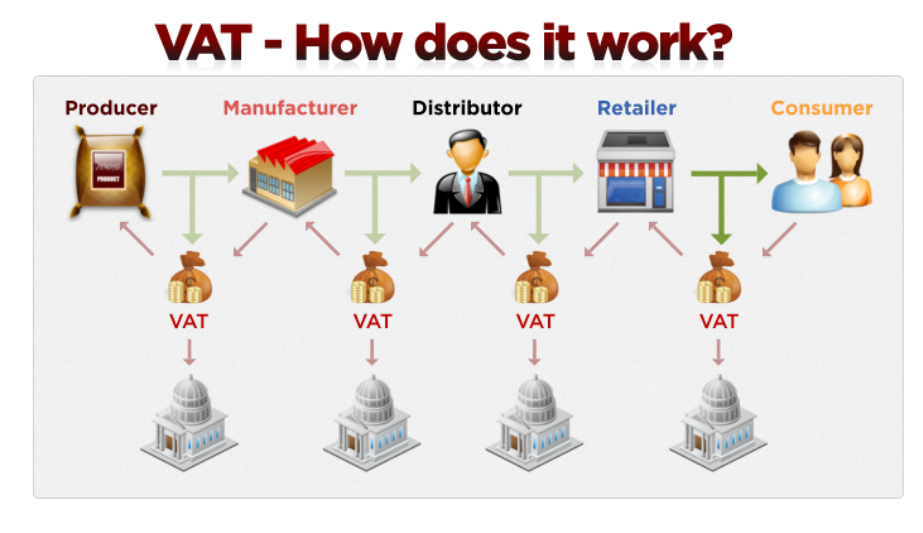

1. What is VAT? Value Added Tax (VAT) is an indirect tax on consumption, charged on the supply of taxable goods and services. It is levied on transactions rather than directly on income or profit, and is also levied on the importation of goods and services....