by Innocent Machabe | May 23, 2018 | Taxation

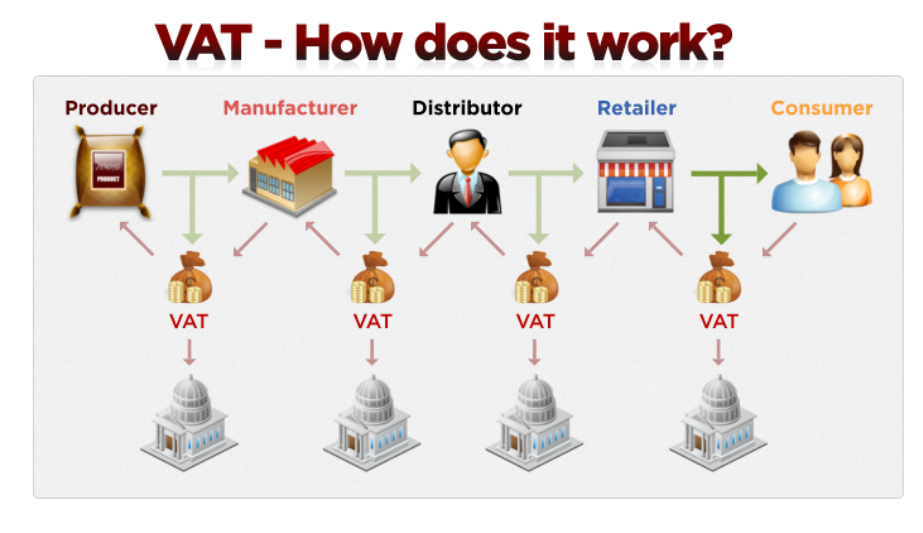

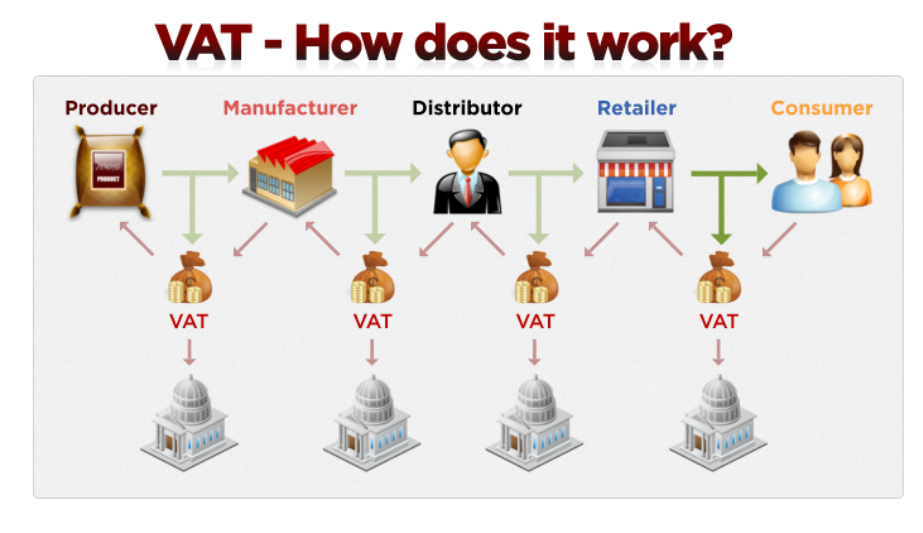

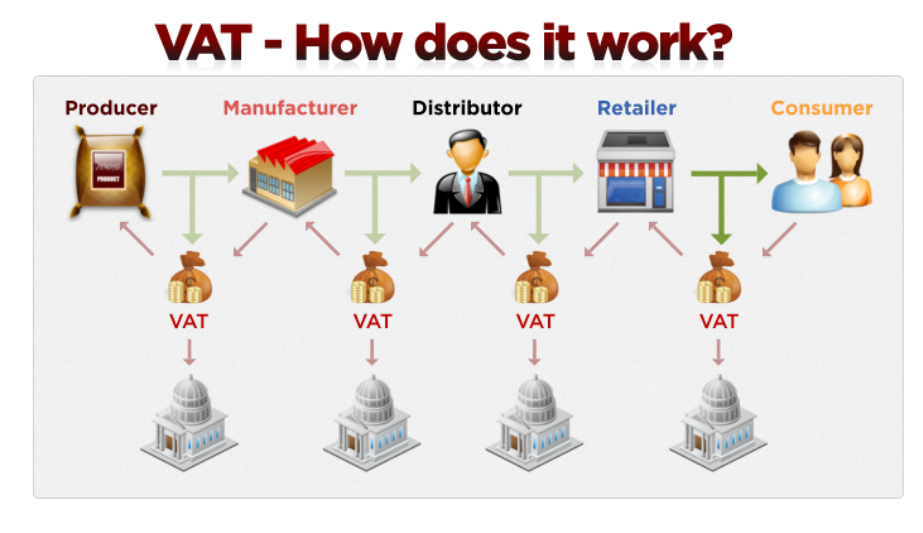

1. What is VAT? Value Added Tax (VAT) is an indirect tax on consumption, charged on the supply of taxable goods and services. It is levied on transactions rather than directly on income or profit, and is also levied on the importation of goods and services....

by Innocent Machabe | May 15, 2018 | Accounting

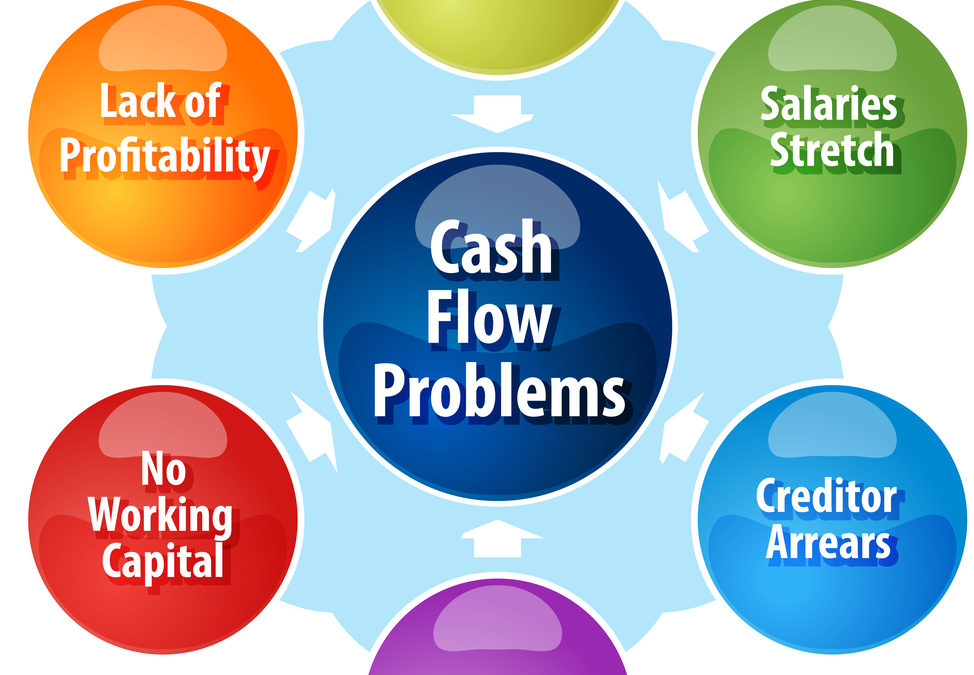

Staying in the black is one of the keys to business success. Try these 7 tips to successfully manage your cash flow. Knowing your customer Check out the exact name and legal status of the business you are supplying. If it’s a sole trader (Private Business...

by Innocent Machabe | May 10, 2018 | Accounting

The purpose of any internal control procedure is to provide reasonable assurance that the organisation can meet its objectives. The Turnbull Report defined internal control and its scope as follows: ‘The policies, processes, tasks, behaviours and other aspects of an...

by Innocent Machabe | May 2, 2018 | Secretarial

When one decides to register a company there are two types of companies that are commonly used in business particularly in Zimbabwe namely a private limited company and a private business corporation. In this article l will talk about a private business corporation....

by Innocent Machabe | Apr 27, 2018 | Taxation

Bad debts arise when customers who buy on credit fail to pay the debt and this triggers the trader to claim a deduction against their income for Income Tax purposes. The debt that is allowable as a deduction is that debt which the trader proves to be irrecoverable....